Blue Connect** is a select network plan for eligible employers who want to offer their employees a lower-priced plan option with high-quality, coordinated care. Members have access to Ochsner Health Network (OHN) and other participating providers. Plan options include POS, HSA-eligible***, qualified high-deductible health plans, and an All Copay Plan.

See Community Blue Service Area

See Community Blue Service Area

See Precision Blue Service Area

See Precision Blue Service Area

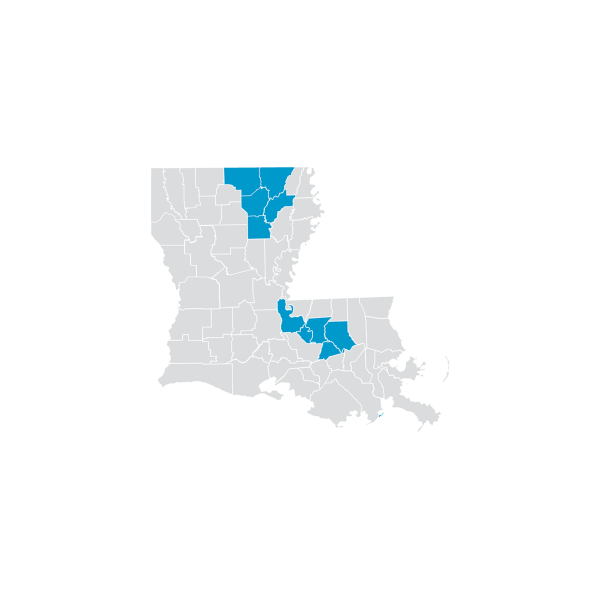

Precision Blue** is a select network plan for eligible employers in the Greater Baton Rouge and Greater Monroe/West Monroe areas who want to offer their employees a lower-priced plan option with high-quality, coordinated care. Members have access to Franciscan Missionaries of Our Lady Health System (FMOLHS) and other participating providers.

Blue Cross and Blue Shield of Louisiana and HMO Louisiana, Inc. offer traditional Administrative Services Only (ASO) arrangements, as well as Small Business Funding Solutions (aka Level-funding).

We offer self-funded health plans a wide array of medical, dental and vision plan designs.

Which arrangement best fits your health plan’s needs to lower healthcare costs and mitigate risk increases?

**Our series of point-of-service (POS) plans and HMO plans are offered by HMO Louisiana, Inc., a wholly owned subsidiary of Blue Cross and Blue Shield of Louisiana.

***HealthEquity, Inc., is an IRS authorized non-bank custodian of HSAs, and the preferred HSA custodian for eligible Blue Cross members enrolled in our high-deductible health plans. Members who qualify may open an HSA with any HSA trustee or custodian and should seek guidance from a tax professional or financial advisor. Blue Cross and Blue Shield of Louisiana and HealthEquity are not engaged in rendering tax, legal or investment advice. These materials, and any tax-related statements in them, are not intended or written to be used, and cannot be used or relied on, for the purpose of avoiding tax penalties. Tax-related statements, if any, may have been written in connection with the promotion or marketing of the transaction(s) or matter(s) addressed by these materials. You should seek advice based on your particular circumstances from an independent tax advisor regarding the tax consequences of specific health insurance plans or products. See IRS Publication 969 for more about HSAs.